Empowering Your Business: The Role of Legal & Tax Attorneys in Retail

The landscape of retail shopping is ever-evolving, with new technologies, consumer habits, and regulatory frameworks emerging continuously. For business owners operating in this dynamic industry, ensuring compliance while maximizing profits is paramount. This is where the expertise of legal & tax attorneys becomes invaluable.

Understanding the Importance of Legal & Tax Attorneys

Legal & tax attorneys specialize in navigating the complex legal and tax issues that businesses face. Their role extends beyond mere compliance; they act as strategic partners who help businesses thrive within the legal framework. Here’s how их expertise can significantly impact the retail sector:

1. Compliance with Regulatory Standards

In the retail environment, businesses are subject to various local, state, and federal regulations. Legal & tax attorneys help ensure that your business adheres to all applicable laws, reducing the risk of legal issues that could harm your reputation and bottom line. Some critical areas of compliance include:

- Consumer Protection Laws: These laws protect consumers from unfair business practices and require businesses to disclose specific information.

- Employment Regulations: Ensuring compliance with labor laws, including wage and hour laws, can prevent costly lawsuits.

- Environmental Regulations: Sustainable practices are increasingly important; understanding these laws can give you a competitive edge.

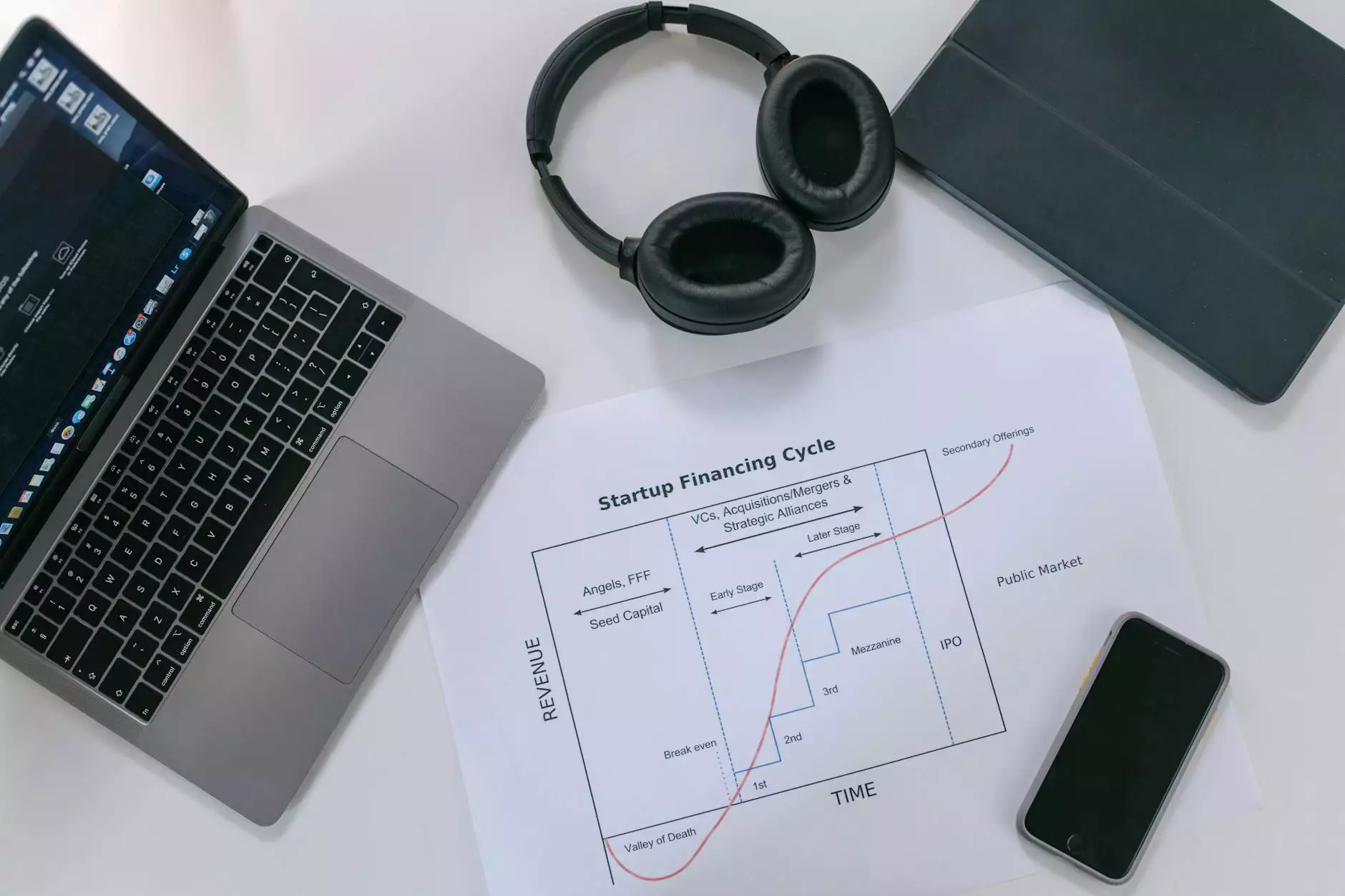

2. Tax Planning and Optimization

A comprehensive tax strategy is critical for any business. Legal & tax attorneys not only assist with compliance but also help businesses identify opportunities for tax savings through effective planning. Key steps in tax optimization include:

- Identifying Tax Deductions: Legal experts can help pinpoint deductions that may not be immediately apparent to the average business owner.

- Entity Selection: Choosing the right business structure—LLC, corporation, or partnership—can have significant tax implications.

- Tax Credits: Navigating available tax credits can directly impact your bottom line.

3. Risk Management and Mitigation

Every business faces risks, but knowing how to manage them effectively can set a retailer apart from competitors. Legal & tax attorneys provide guidance on risk management strategies that can protect your assets, including:

- Contractual Agreements: Properly drafted contracts can prevent disputes and ensure both parties meet their obligations.

- Insurance Advice: Understanding the types of insurance necessary for your specific business can shield you from unexpected losses.

- Litigation Support: In the event of a dispute, having a skilled attorney on your side can be invaluable.

Bridging the Gap Between Business and Law

It is vital for business owners in the retail sector to view legal & tax attorneys as integral components of their management team. By incorporating legal counsel into strategic planning, business owners can enhance operations and align their objectives with legal standards. Here are a few ways to bridge the gap:

1. Regular Legal Audits

Conducting regular legal audits can help identify potential compliance issues before they escalate into legal problems. Attorneys can recommend best practices and adjustments to ensure ongoing compliance and strategic alignment.

2. Ongoing Education

Keeping abreast of changing laws and trends in the retail landscape is crucial. Regular workshops and seminars hosted by legal & tax attorneys can educate business owners and employees about important regulatory changes, improving overall compliance awareness.

3. Customized Legal Strategies

Each business is unique, and thus requires tailored legal solutions. Working closely with your attorney to develop customized legal strategies that align with your business goals will enhance your operational efficacy and foster sustainable growth.

The Financial Advantages of Legal Counsel

While there may be an upfront cost associated with hiring legal & tax attorneys, the long-term savings often outweigh such expenses. Consider the financial advantages:

1. Avoiding Penalties and Fines

Non-compliance can lead to substantial fines and legal actions. By proactively managing compliance, businesses can avoid these detrimental financial consequences.

2. Minimizing Legal Fees

Engaging legal counsel early can help avert lengthy and costly litigation. Attorneys can provide preventative measures and identify risks before they lead to expensive legal battles.

3. Maximizing Profitability

Effective tax planning and compliance can lead to increased profitability. By ensuring that your business takes advantage of all available tax benefits, you can significantly enhance your financial position.

Finding the Right Legal & Tax Attorney for Your Retail Business

Choosing the right legal & tax attorneys for your business is crucial. Here are several factors to consider:

1. Experience in Retail

Look for attorneys with experience in the retail sector specifically, as they will have a better understanding of the unique legal challenges you face.

2. Comprehensive Service Offerings

Your attorney should provide a wide range of services including compliance, contract drafting, tax planning, and litigation support.

3. Strong Communication Skills

Effective communication is vital; your attorney should be able to explain complex legal concepts in clear, straightforward terms.

4. Retainer vs. Hourly Billing

Understand the fee structure. Some attorneys operate on a retainer basis, while others bill hourly. Choose a structure that fits your business model and budget.

Conclusion: The Crucial Role of Legal & Tax Attorneys in Business Growth

In conclusion, the role of legal & tax attorneys extends far beyond simple compliance. They are essential partners that help retail businesses navigate the challenges of a complex regulatory environment while optimizing tax strategies that contribute to sustained growth. By integrating legal expertise into your broader business strategy, you are not just safeguarding your operations; you are paving the way for a stronger, more lucrative future.

Investing in quality legal counsel is investing in the long-term success of your business. Embrace the expertise of legal & tax attorneys and watch your venture thrive in the competitive retail landscape.